- Standard and Poor's, Moody's and Fitch, the top three global rating agencies, has given Colombia an investment grade since 2011. This assures a risk-free investment in Colombia.

- The World Bank´s "Doing Business" 2011 edition, classifies Colombia as the fifth country in the world and first in Latin America that most protects foreign investors.

- According to the report made by "The Independent" newspaper in the United Kingdom, Colombia is ranked as one of the two countries with best investment opportunities in Latin America .

- The International Institute for Managment Development (IMD), ranks Colombia as second in Latin America for personal safety and suitable protection of private property.

Investment Sectors in Colombia

Anyone who is interested

in investing in Colombia can count with our experience and support, prompt and assertive advice for the

development of investment opportunities in Colombia.

Investments in : Forestry, Shrimp, Biofuels, Cocoa, Cosmetics, Construction, Automotive, Tourism, Goods and Services, Software and IT services, and Private equity funds.

Investment in Agribusiness

in Colombia

Investment in Manufacturing

in Colombia

Investment in Services

in Colombia

WATCH PRESENTATION

Inn Reach Communications, will provide a world-class service to meet your needs

- Tailored information.

- Public and private sector contacts.

- Organized agendas and guides for your visits to Colombia.

- All services and the information provided throughout the process will be handled with the utmost confidentiality.

Original Art print by Carito

Original Art print by Carito

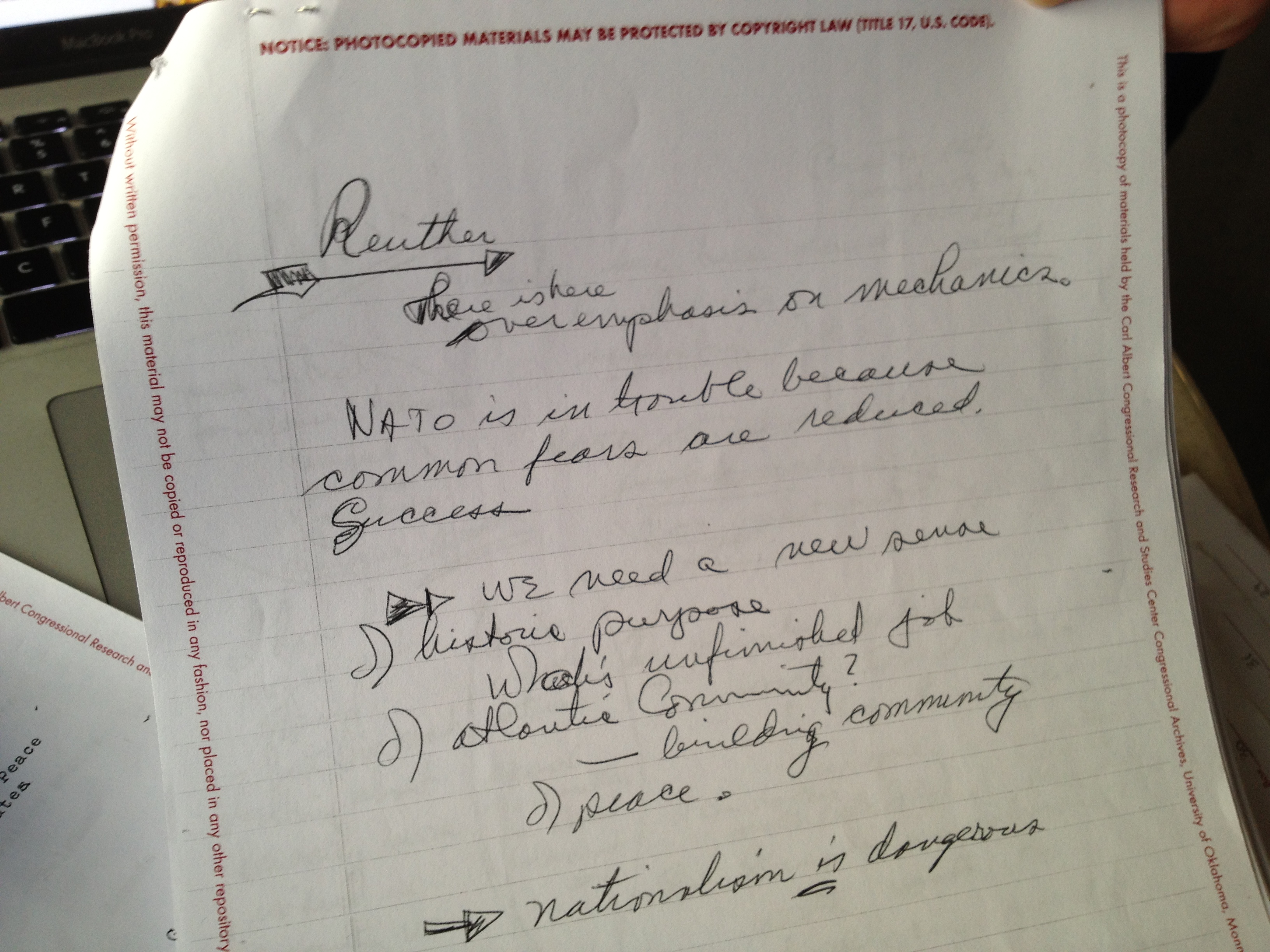

Leaked Bilderberg Documents: “Nationalism Is Dangerous”

Wednesday, June 6, 2012

Editor’s Note: We have obtained hundreds of documents from the 1966 meeting. This is a Wikileaks-sized data dump and we will be writing several more articles over the next few days to cover the myriad of different issues at hand.

Leaked documents from the 1966 Bilderberg Group

conference exclusively obtained by Infowars betray how even as far back

as five decades ago U.S. Senators were being indoctrinated with the

belief that “nationalism is dangerous” by Bilderberg elitists, in

addition to top union heads scheming behind their members’ backs with

titans of capitalism and industry.

Previously leaked documents from meetings have

illustrated how the Bilderberg Group, contrary to the media-generated

myth that the confab represents a harmless talking shop, sets the

consensus for policy decisions sometimes decades in advance.

A clear example is the 1955 Bilderberg meeting held in Garmisch-Partenkirchen, West Germany. Documents read by the BBC and later released by Wikileaks divulge

how Bilderberg members were discussing the creation of the euro single

currency nearly 40 years before it was officially introduced in the 1992

Maastricht Treaty.

The documents obtained by Infowars are from the

Bilderberg Group meeting which took place in Wiesbaden, Germany in late

March 1966.. The files are marked “personal and strictly confidential,”

and “Not for publication either in whole or in part.” They consist of

Bilderberg’s agenda for that year’s confab along with hand-written notes

made by Democratic U.S. Senator for Oklahoma Fred R. Harris, who

attended the meeting. READ MORE

Collapse At Hand

Infowars.com

June 6, 2012

Ever since the beginning of the financial crisis and quantitative easing, the question has been before us: How can the Federal Reserve maintain zero interest rates for banks and negative real interest rates for savers and bond holders when the US government is adding $1.5 trillion to the national debt every year via its budget deficits? Not long ago the Fed announced that it was going to continue this policy for another 2 or 3 years. Indeed, the Fed is locked into the policy. Without the artificially low interest rates, the debt service on the national debt would be so large that it would raise questions about the US Treasury’s credit rating and the viability of the dollar, and the trillions of dollars in Interest Rate Swaps and other derivatives would come unglued.

In

other words, financial deregulation leading to Wall Street’s gambles,

the US government’s decision to bail out the banks and to keep them

afloat, and the Federal Reserve’s zero interest rate policy have put the

economic future of the US and its currency in an untenable and

dangerous position. It will not be possible to continue to flood the

bond markets with $1.5 trillion in new issues each year when the

interest rate on the bonds is less than the rate of inflation. Everyone

who purchases a Treasury bond is purchasing a depreciating asset.

Moreover, the capital risk of investing in Treasuries is very high. The

low interest rate means that the price paid for the bond is very high. A

rise in interest rates, which must come sooner or later, will collapse

the price of the bonds and inflict capital losses on bond holders, both

domestic and foreign.

In

other words, financial deregulation leading to Wall Street’s gambles,

the US government’s decision to bail out the banks and to keep them

afloat, and the Federal Reserve’s zero interest rate policy have put the

economic future of the US and its currency in an untenable and

dangerous position. It will not be possible to continue to flood the

bond markets with $1.5 trillion in new issues each year when the

interest rate on the bonds is less than the rate of inflation. Everyone

who purchases a Treasury bond is purchasing a depreciating asset.

Moreover, the capital risk of investing in Treasuries is very high. The

low interest rate means that the price paid for the bond is very high. A

rise in interest rates, which must come sooner or later, will collapse

the price of the bonds and inflict capital losses on bond holders, both

domestic and foreign.The question is: when is sooner or later? The purpose of this article is to examine that question.

Let us begin by answering the question: how has such an untenable policy managed to last this long? READ MORE

Envie Dinero desde Colombia a USA

No hay comentarios.:

Publicar un comentario